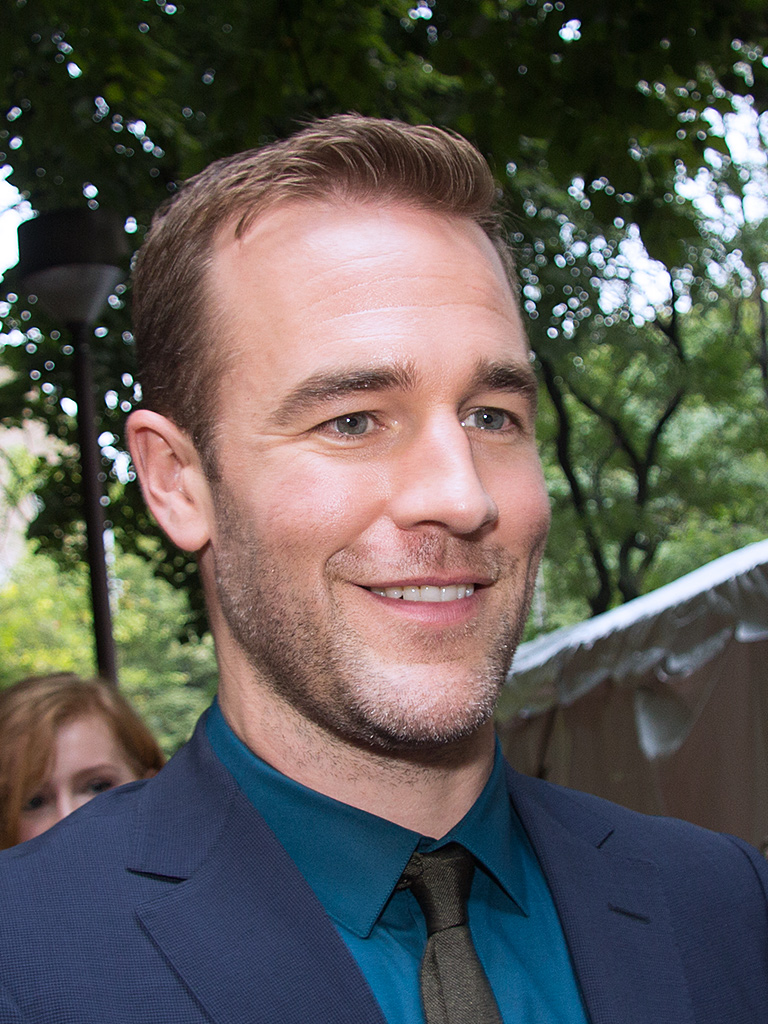

After Dawson's Creek: James Van Der Beek's Family Seeks Stability Amidst Financial Strain

The recent passing of beloved actor James Van Der Beek sent shockwaves through Hollywood and among fans worldwide. Known for his iconic portrayal of Dawson Leery in Dawson's Creek, as well as roles in Pose, CSI: Cyber, and films like Varsity Blues, Van Der Beek left an indelible mark on entertainment. However, beyond the tributes and eulogies, a stark reality emerged: his family, led by his wife Kimberly Van Der Beek, is facing significant financial hardship following his battle with colorectal cancer.

This revelation brings to light a crucial and often overlooked aspect of celebrity life: fame and a seemingly impressive James Van Der Beek Net Worth do not always translate into lasting financial security, especially when confronted with the devastating costs of a prolonged illness. Kimberly Van Der Beek's heartfelt plea through a GoFundMe campaign underscores the universal vulnerability to medical expenses and the critical need for robust financial planning.

The Legacy of a Beloved Actor: From Dawson Leery to Devoted Father

James Van Der Beek, who passed away on February 11, 2026, at the age of 48, was more than just a famous face. To many, he was the quintessential boy-next-door, a symbol of late 90s television. His career spanned decades, showcasing his versatility across various genres. From the dramatic depths of Dawson's Creek (1998-2003) to his acclaimed turn in Pose and a prominent role in CSI: Cyber, Van Der Beek consistently worked, building a recognizable profile.

Beyond the bright lights of Hollywood, James was a dedicated family man. He and his wife, Kimberly, shared six children: daughters Olivia, Annabel, Emilia, and Gwendolyn, and sons Joshua and Jeremiah. This large family was the center of his world, a fact that makes the current financial struggles even more poignant. The public outpouring of grief from former co-stars, peers, and fans speaks volumes about his impact, both on-screen and through his personable off-screen demeanor.

Unpacking the Financial Reality: A $3 Million Net Worth and Mounting Medical Bills

For many, the concept of a celebrity facing financial challenges can be perplexing. Reports estimate James Van Der Beek's net worth at approximately $3 million as of February 2026. On the surface, this figure might suggest a comfortable cushion. However, the tragic truth, as revealed by Kimberly's GoFundMe description, is that the extensive treatment for his stage 3 colorectal cancer "left the family out of funds."

James first announced his diagnosis in November 2024, a year after initial diagnosis in 2023. The battle against cancer is not only emotionally and physically draining but also astronomically expensive. Even with good health insurance, out-of-pocket costs can quickly decimate savings, especially over an extended period. These expenses can include:

- Specialized treatments and medications not fully covered by insurance.

- Co-pays and deductibles that reset annually.

- Travel and accommodation for treatment at specialized centers.

- Loss of income for both the patient and caregivers.

- Costs associated with alternative therapies or supportive care.

The reality is that a multi-million dollar net worth, while substantial, can evaporate quickly under the relentless pressure of a serious, long-term illness. This situation serves as a stark reminder that James Van Der Beek's Medical Bills Drained Funds Despite $3M Net Worth, highlighting a universal vulnerability many families face in the US healthcare system.

Kimberly Van Der Beek's Heartfelt Plea for Stability

In the wake of James's passing, Kimberly Van Der Beek launched a GoFundMe campaign, openly sharing the family's precarious situation. The goal is clear: to ensure the children can "continue their education and maintain some stability during this incredibly difficult time" and to "stay in their home." The campaign aims to raise $500,000 to cover essential living expenses, pay bills, and support the children's education.

The immediate response from the community has been overwhelming, with over $167,000 amassed in just a few hours. This outpouring of generosity speaks to the collective empathy for a grieving family and the desire to support the children James loved so dearly. Kimberly's message underscores the uncertain future they face, emphasizing that every donation, regardless of size, offers hope and security as they rebuild their lives.

For Kimberly and her six children—Olivia, Annabel, Emilia, Gwendolyn, Joshua, and Jeremiah—this fund is not just about money; it's about preserving a sense of normalcy and continuity during a period of unimaginable loss. It's about giving them the foundation to grieve and heal without the added burden of immediate financial insecurity.

Beyond the Headlines: Critical Lessons on Financial Preparedness and Family Security

The Van Der Beek family's story, while unique in its public nature, offers profound and universal lessons on financial preparedness and the unforeseen challenges life can present. It underscores that even individuals with a significant James Van Der Beek Net Worth can be susceptible to financial devastation without proper planning, especially when confronted with severe medical crises.

Practical Steps for Safeguarding Your Family's Future:

- Prioritize Comprehensive Health Insurance: While not a complete shield, robust health insurance is the first line of defense against catastrophic medical costs. Understand your policy's limits, deductibles, and out-of-pocket maximums. Consider Health Savings Accounts (HSAs) for tax-advantaged savings on medical expenses.

- Establish a Robust Emergency Fund: Aim to have at least 6-12 months of living expenses saved in an easily accessible, liquid account. This fund is crucial for covering unexpected events like job loss, medical emergencies, or other crises.

- Invest in Adequate Life Insurance: This is perhaps the most critical component for families. Life insurance provides a financial safety net, replacing lost income and covering future needs like mortgage payments, children's education, and daily living expenses. Even if you have a significant net worth, life insurance ensures liquidity without liquidating assets, which can be complex and untimely during grief.

- Develop a Clear Estate Plan: A will is fundamental, but a comprehensive estate plan goes further. It should include powers of attorney (for finances and healthcare), and potentially a trust to manage assets for minor children. This ensures your wishes are respected and your family is protected from legal and financial complexities during a difficult time.

- Regularly Review Your Financial Plan: Life circumstances change. Marriages, births, career shifts, or health diagnoses warrant a review of your insurance policies, investments, and estate plan. Financial advisors can be invaluable in navigating these complexities.

- Communicate Openly About Finances: Have candid discussions with your spouse or partner about your financial situation, including assets, debts, insurance policies, and estate plans. This ensures that in the event of an unexpected tragedy, the surviving partner is not left in the dark.

The emotional toll of losing a loved one is immeasurable. The added stress of financial uncertainty can be debilitating. James Van Der Beek's story serves as a powerful testament to the unpredictability of life and the absolute necessity of proactive financial planning. It's a reminder that regardless of one's public profile or perceived wealth, everyone is vulnerable, and preparation is paramount for family security.

Conclusion

James Van Der Beek's journey from a teen idol to a devoted father, and his battle with cancer, has tragically culminated in a moment of public vulnerability for his family. The GoFundMe campaign launched by Kimberly Van Der Beek is a testament to the power of community and compassion, rallying support for a family striving for stability in the face of profound loss. While the circumstances are heartbreaking, they offer a poignant opportunity for reflection. The story of the Van Der Beek family underscores that true security lies not just in an individual's net worth, but in the foresight to plan for the unexpected, ensuring that loved ones are protected through life's most challenging moments.